What a year 2025 has been for Kauai vacation rental owners. If you’ve been in the game, you know it felt like riding a rollercoaster: some incredible highs, a few stomach-dropping lows, and plenty of unexpected twists that kept us all on our toes.

As we wrap up the year, let’s take a honest look at how the vacation rental landscape shifted under our feet and what it meant for property owners across the island. Spoiler alert: it wasn’t all doom and gloom, but it definitely required some serious adaptation.

The Tourism Reality Check

Let’s start with the elephant in the room: Hawaii tourism took a hit in 2025. Visitor numbers and spending both dropped over 4% compared to 2024, with the decline really showing up during the summer months.[^1] For Kauai property owners, this translated into fewer potential guests browsing listings and booking stays.

But here’s the interesting part: while fewer people were visiting, the ones who did come were willing to pay significantly more for quality experiences. This created a unique dynamic where smart property owners could still thrive if they positioned their rentals correctly.

The Great Rate Revolution

Despite fewer tourists, 2025 became the year of premium pricing power. Kauai vacation rentals achieved an average daily rate of $464 in June 2025: that’s an 18% jump from 2024 and a whopping 72% increase from pre-pandemic 2019 levels.[^2]

To put this in perspective, vacation rental owners were commanding higher nightly rates than many of the island’s hotels, which averaged $440 during the same period.[^3] This pricing advantage became a game-changer for owners who knew how to leverage it properly.

The Kapaa Success Story

Some areas really figured out the formula. Take Kapaa, for example: properties there maintained an impressive 87% occupancy rate while averaging $313 per night, generating around $87,000 in annual revenue per listing.[^4] These numbers proved that location, pricing strategy, and guest experience could still deliver exceptional results even in a challenging market.

The Occupancy Challenge

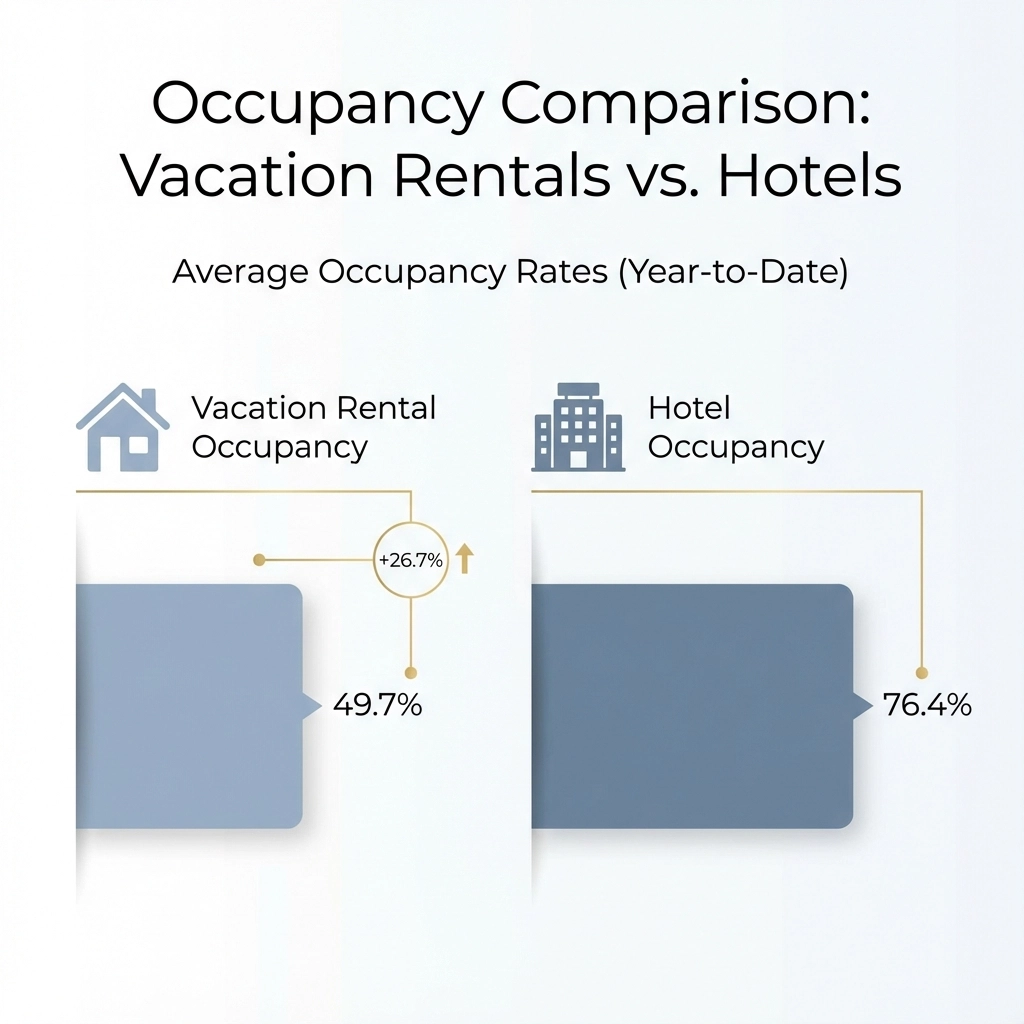

Here’s where things got tricky. While rates soared, overall occupancy rates took a dive. Kauai vacation rentals averaged just 49.7% occupancy in June 2025, down from the previous year and significantly below the 75.9% we saw back in 2019.[^2]

Compare that to hotels hitting 76.4% occupancy, and you can see the competitive pressure vacation rental owners faced.[^3] The message was clear: guests were becoming more selective, and only the best-managed properties were capturing their attention.

This occupancy challenge separated the pros from the amateurs. Properties with professional management, dynamic pricing strategies, and exceptional guest experiences continued to book solid, while others struggled to fill calendar gaps.

Real Estate Market Shake-Up

The property investment landscape got interesting too. While home sales jumped 38% from September 2024 to 2025, condo sales: where many vacation rentals live: actually dropped 26%.[^5] This suggested some owners were either exiting the market or holding tight to their investments.

Vacant land prices shot up 39% to an average of $985,000,[^5] indicating that despite the tourism challenges, investors still saw long-term value in Kauai real estate. The Kōloa and Līhu’e areas emerged as hot spots for residential sales, while Kawaihau surprised everyone with strong condo activity driven by vacation rental interest.[^5]

How Guest Expectations Evolved

2025 guests weren’t just looking for any vacation rental: they wanted premium experiences that justified higher rates. We saw a major shift toward properties offering:

- Professional photography and staging that showcased the true potential of each space

- Seamless check-in processes with digital locks and detailed welcome guides

- Local experience curation beyond just providing generic tourist recommendations

- Immediate response times for any issues or questions during their stay

Properties that delivered on these expectations thrived, while those sticking to the old “post-and-pray” approach found themselves with longer vacancy periods.

The Sandy Door Advantage

This is where companies like Sandy Door really made the difference for property owners. While the market got more competitive, we adapted our approach to help owners not just survive, but actually increase their revenue.

Our 80% average occupancy rate stood out significantly against the island average of 49.7%.[^2] How? Through aggressive dynamic pricing algorithms that adjusted rates in real-time based on demand patterns, competitor analysis, and local events.

But occupancy was just part of the equation. We also focused on:

- Strategic rate optimization that balanced higher ADRs with consistent bookings

- Professional property presentation with high-quality photos and detailed listings

- 24/7 guest support that maintained five-star reviews and repeat bookings

- Local market expertise that positioned properties ahead of competition

Our all inclusive management fee structure became even more attractive as owners realized they were actually netting more income than higher-occupancy competitors charging 30%+ fees plus additional charges for lines, credit card fees, GET/TAT filing and much more.

Technology and AI Integration

2025 marked the year AI pricing really came into its own. Properties using dynamic pricing algorithms consistently outperformed those with static pricing by 15-25% in revenue generation.[^6]

The technology got sophisticated enough to factor in everything from weather forecasts to local event calendars, cruise ship arrivals, and even social media trending topics about Kauai.[^7] This granular approach to pricing optimization became essential for maximizing revenue in a lower-volume tourism environment.

Owners who embraced these technological advances found themselves with a significant competitive edge, while those relying on “gut feeling” pricing struggled to adapt to rapid market changes.

Regulatory and Tax Landscape

Let’s be honest: Kauai’s regulatory environment continued evolving in 2025, and staying compliant became more complex than ever. Between county regulations, tax requirements, and permit renewals, property owners faced an administrative burden that many underestimated.

Professional management companies became invaluable here, handling the compliance paperwork and staying current with changing requirements so owners could focus on their core business or day jobs.

What Worked (And What Didn’t)

Looking back at the year, certain strategies clearly separated successful owners from struggling ones:

What Worked:

- Dynamic pricing based on real-time market data

- Professional property management with local expertise

- Investment in high-quality photos and property staging

- Proactive guest communication and support

- Focus on guest experience over pure cost-cutting

What Didn’t Work:

- Static pricing strategies that ignored market fluctuations

- DIY management without local market knowledge

- Competing purely on price without offering additional value

- Ignoring guest feedback and review management

- Underinvestating in property maintenance and updates

Looking Forward: The New Normal

As we head into 2026, it’s clear that 2025’s challenges weren’t temporary blips: they represent the new normal for Kauai vacation rentals. Success requires professional-level execution across pricing, marketing, guest experience, and property management.

The properties that adapted to this reality are already seeing the benefits. Higher rates are sustainable when paired with exceptional experiences. Lower overall tourist volume doesn’t mean lower revenue if you’re capturing the right guests.

For property owners, the message is clear: the amateur hour is over. This market rewards professionalism, strategic thinking, and guest-focused execution. Those who embrace these realities will find 2026 brings even better opportunities.

The Kauai vacation rental market evolved significantly in 2025, but for owners who adapted smartly: whether through professional management partnerships or by dramatically upgrading their own operations: it actually became more profitable than ever.

Ready to make 2026 your best year yet? The fundamentals are clear, and the opportunities are waiting for owners ready to execute at a professional level. See how much income can your property generate here.

Sources

[^1]: Hawaii Tourism Authority — Monthly Visitor Statistics (2025): https://www.hawaiitourismauthority.org/research/monthly-visitor-statistics/; October 2025 Visitor Statistics Press Release (DBEDT/HTA): https://www.hawaiitourismauthority.org/media/15247/october-2025-visitor-statistics-press-release.pdf

[^2]: Hawaii Tourism Authority; DBEDT — June 2025 Hawai’i Vacation Rental Performance Report (PDF): https://www.hawaiitourismauthority.org/media/14652/june-2025-hawaii-vacation-rental-performance-final.pdf

[^3]: Kaua‘i hotel performance, June 2025 — Kaua‘i County Visitor Industry Data (links to HTA reports): https://www.kauai.gov/Visitors/Visitor-Industry-Data; Skift Daily Lodging Report coverage: https://dlr.skift.com/2025/09/03/hawaiis-hotels-see-some-declines-in-2025-performance/

[^4]: Kapaa short‑term rental performance (2025) — Airbtics: https://airbtics.com/annual-airbnb-revenue-in-kapaa-hawaii-usa/; Awning Market Data: https://awning.com/a/airbnb-market-data/Kapaa-HI

[^5]: Team Mira, Corcoran Pacific Properties — September 2025 Kauai Real Estate Market Update: https://kauaipropertysearch.com/news/kauai-real-estate-stats/september-2025-kauai-real-estate-market-update-team-mira-corcoran-pacific-properties/

[^6]: Abrate, Sainaghi, Mauri — Dynamic pricing in Airbnb: Individual versus professional hosts. Journal of Business Research (2022): https://ideas.repec.org/a/eee/jbrese/v141y2022icp191-199.html

[^7]: PredictHQ case study — Wheelhouse increased revenue through event‑based dynamic pricing: https://www.predicthq.com/customers/wheelhouse